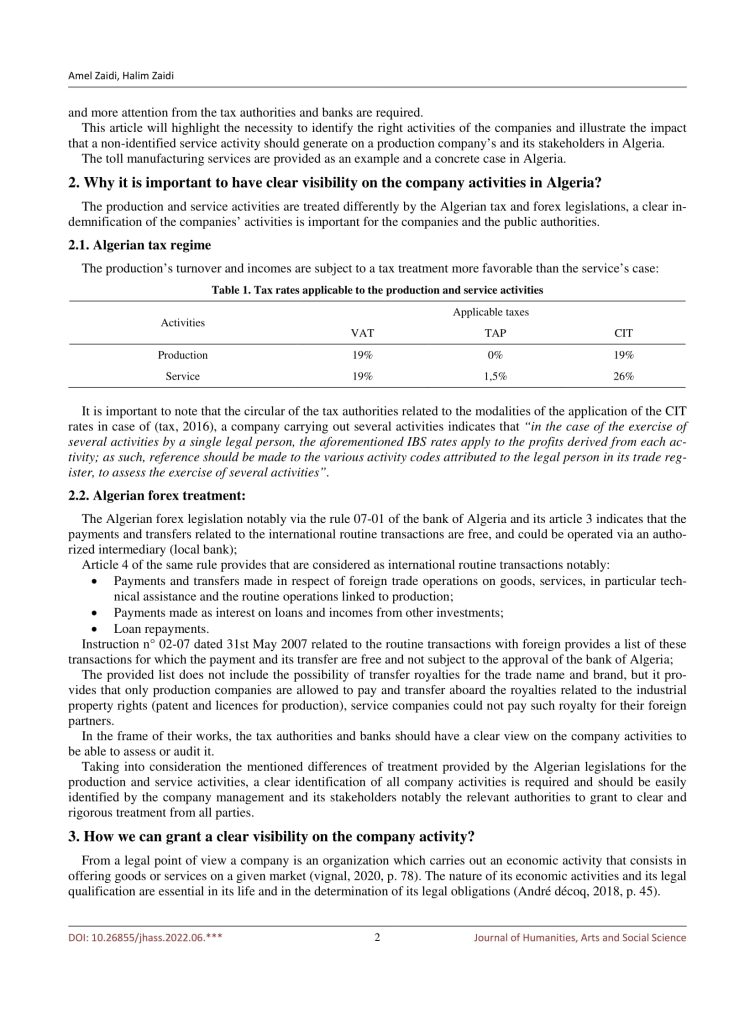

Different stakeholders of a company use the bylaws and the trade register to identify its activities, the absence of a code dedicated to one or several activities may reduce their visibility and impact their potential decisions. This topic takes a significant importance in Algeria where different activities are subject to different treatments from tax and forex sides.

The absence of the right activity code on the company trade register may create several complications for the company and its stakeholders, as the tax authorities may consider that a company is carrying out only production activity, and grant the favorable tax regime applicable to production activity to its global turnover,while it is providing in addition to its production activity services to its clients (service activity does not benefit from this favorable tax regime); this lack of visibility of the company’s activities impacts in addition to the tax authorities, the decisions of commercial banks and potential investors The toll manufacturing is a service activity that production companies having assets (machines and plants) provide to their clients generally under a subcontract agreement is taken as an example in this article (notably as the Algerian trade register nomenclature does not provide a dedicated code to this activity) to illustrate this problematic and highlight the necessity to consider it in Algeria